| Symbol | Current Price (As of --) |

Daily $ Change |

Daily % Change |

|---|---|---|---|

| -- | -- | -- | -- |

Objective

Ave Maria World Equity Fund seeks long-term capital appreciation from equity investments in companies that do not violate core values and teachings of the Roman Catholic Church.

Total Returns

| For the PERIODS ENDING 4/30/25 | ANNUALIZED | |||||

|---|---|---|---|---|---|---|

| Fund | Year-to- Date |

1 Year |

3 Years |

5 Years |

10 Years |

Since Inception |

Total Returns

| For the PERIODS ENDING — | ANNUALIZED | |||||

|---|---|---|---|---|---|---|

| Fund | Year-to- Date |

1 Year |

3 Years |

5 Years |

10 Years |

Since Inception |

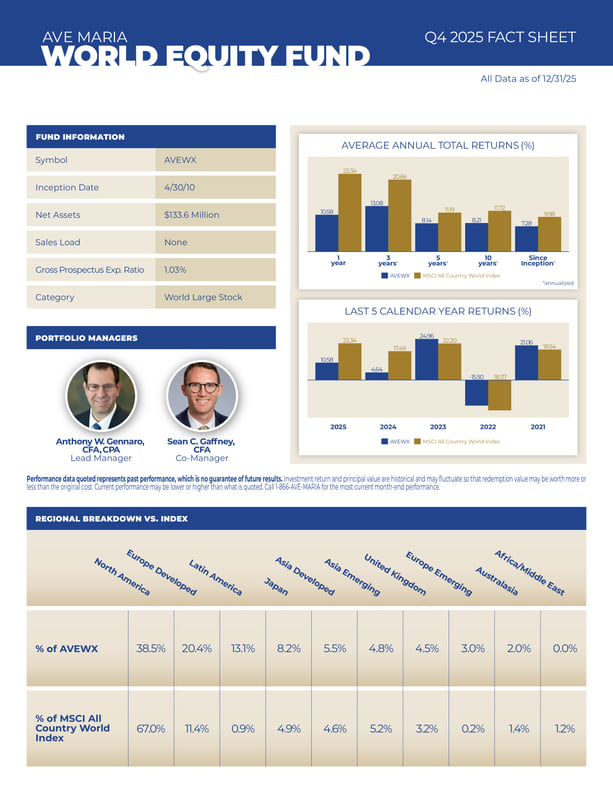

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value are historical and may fluctuate so that redemption value may be worth more or less than the original cost. Current performance may be lower or higher than what is quoted. Call toll-free 1-866-AVE-MARIA for the most current month-end performance.

Ave Maria Mutual Funds are no-load and have no sales charges or commissions. They are available to investors through various types of investment accounts, including individual, joint, custodial and retirement accounts such as IRAs. Coverdell Education Savings Accounts are also available. Fund services include Automatic Investment Plan (AIP) option and Automatic Withdrawal option. The minimum initial investment for each Fund is $2,500. To invest, please read the prospectus carefully, complete the application, and return your check and application. The Funds are also available through many different financial services firms, who may charge additional fees. Some of the firms that offer our Funds are listed here. If you have a financial professional helping you with your investments, tell them about your interest in Ave Maria Mutual Funds.

The MSCI All Country World Index is a broad global equity index that designed to track broad global equity-market performance. Maintained by Morgan Stanley Capital International (MSCI), the index is comprised of the stocks of about 3,000 companies from 23 developed countries and 26 emerging markets.

Indexes do not incur fees and it is not possible to invest directly in an index.